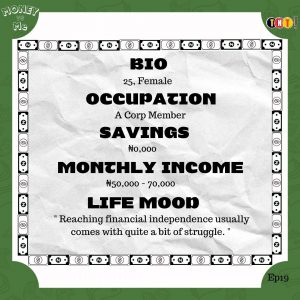

#MoneyvsMe 19; A Corp Member’s Hustle Between Debts and Dreams

Every week, TNT wants to know how people move money in and out of their lives. Certain stories will be challenging,while others will be extravagant. It will always show something new to learn.

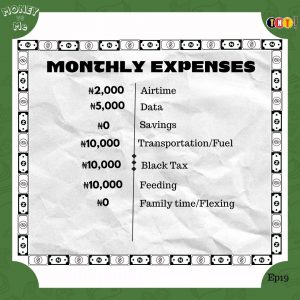

#MoneyvsMe 19; A Corp Member’s Hustle Between Debts and Dreams. So there I was, in the third month of my National Youth Service Corps (NYSC) in Abuja, just staring at this long list of unpaid bills. I had less than a week to pay the rent for my tiny one-room flat, and honestly, my savings from before moving to this busy city were all gone. So, at 25, just finishing up university with my economics degree, I thought my NYSC service year would really open doors for me. It turned into a year just focused on getting by. I got assigned to a government ministry right in the centre of Abuja, where I was making a pretty small monthly allowance of ₦33,000 from the NYSC, plus an extra ₦10,000 as my stipend from the ministry. But, you know, with the cost of living in Abuja being so high, that amount hardly stretched to cover my transportation, food, and the little bit I sometimes sent back to my parents in Kaduna.

Five months into my service year, I found myself really struggling with debt. I borrowed some money from friends to cover my flat deposit when I first moved in, and even though I tried my hardest to stick to a budget, unexpected expenses just kept coming up. So, just last week, I had to get my phone screen fixed because it shattered—another ₦20,000 down the drain. So, my bank account is in the red now, and I ended up borrowing some cash from a quick loan app just to manage my monthly transport and food costs. The interest rates were tough, and the idea of paying them off seemed like a mountain I’d never get over. I really didn’t like all those notifications and text messages about my outstanding balance.

Even though I was having a tough time with money, I really wanted to land a permanent job before my service year wrapped up. So, every evening after my regular 9-to-5, I’d browse through job boards online, tweak my CV, and shoot out a bunch of applications to companies all over Abuja. I went to a few interviews, but nothing really came of them. The job market in Abuja is pretty competitive, which didn’t really help things out. The city was buzzing with young professionals, all competing for the few opportunities available in the capital.

I felt a bit overlooked as a corper—my status kind of made me seem temporary, which made employers a little hesitant to really commit. I really felt frustrated by not getting any feedback. It felt like weeks would pass without hearing anything from recruiters, and when I finally got to the interview stage, it was a tough process. Honestly, I remember spending more than three hours in an interview at a consulting firm, and then getting the news that they were “considering more experienced candidates.”

I realised I couldn’t just depend on my NYSC allowance, so I decided to explore a few side hustles. I began providing freelance tutoring for students who could use some extra help with maths, charging 3,000 for each session. It wasn’t a lot, but it helped me get by for now. I helped a friend out with their small digital marketing business by managing their social media accounts, and in return, I got a bit of extra cash. On weekends, I’d catch up with fellow corps members at popular hangout spots in Abuja, like Jabi Lake Mall.

I connect with other young professionals there, looking to network my way into a more stable job opportunity. But you know, socialising came with its own set of challenges—every time I went out, it felt like my delicate budget took a hit.

One night, I was just sitting in the dark in my flat. I ran out of the electricity units I loaded up last week, and I just don’t have the money to buy more right now. My phone buzzed again; it was just another reminder from the loan app. I let out a sigh and buried my face in my hands. I felt really weighed down by my debt and all the uncertainty about the future. That night, I decided something. I just couldn’t go on like this—always battling, always worried about the next bill or alert. I realised I had to handle my finances in a new way, and it was crucial for me to land a solid job before NYSC wrapped up.

The next morning, I decided to take charge and be proactive. I got in touch with a mentor I met back in university, who has experience in the finance sector. So, I shared my situation with my mentor, and guess what? They offered me an internship at a financial advisory firm in Garki! It wasn’t a full-time gig, but it was definitely a way to get my foot in the door—something that could open up more opportunities down the line. I started the internship with a fresh sense of hope, all while managing my NYSC responsibilities. The money I got from the internship, along with my NYSC allowance, helped me clear some of my debts. It was tough—the days dragged on, and I was always tired—but for the first time in ages, I felt like I was making progress.

As my service year was wrapping up, I noticed my financial situation starting to level out. I got some great experience from the internship, and it even led to a recommendation letter in the end. Even with my debts hanging over me and the job hunt still in full swing, I’ve really picked up the knack for perseverance while in Abuja. My NYSC journey hasn’t exactly been a walk in the park. Rather than a year of simple living and carefree exploration, it turned out to be a year of managing debts, side hustles, and endless job applications.

It was definitely a year that showed me how to be resilient and reminded me how crucial it is to keep going, even when things felt tough. Just like a lot of other corps members in Abuja, my experience highlights that reaching financial independence usually comes with quite a bit of struggle. With a bit of persistence and some luck, dreams can really start to come together, even when things get tough.